|

A. Local Corporation

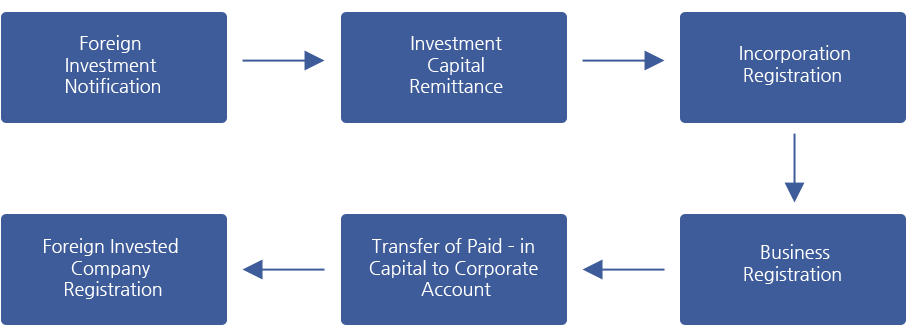

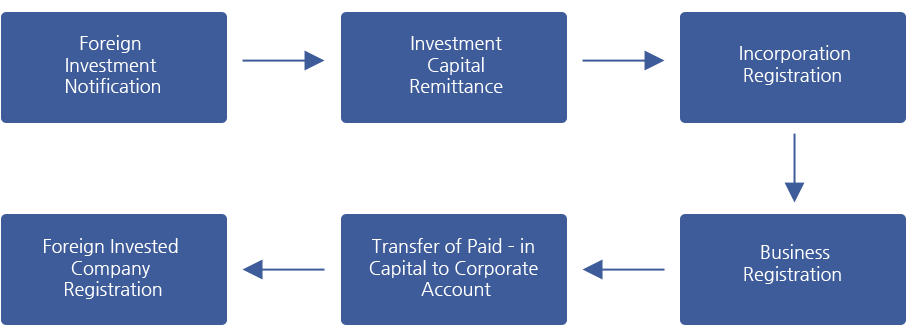

The procedure for establishment of a local corporation can be classified into four steps:

1. Foreign investment notification

2. Investment Capital Remittance

3. Incorporation and Business registration

4. Foreign Invested company registration.

The procedure is basically identical to the corporation establishment procedure applied to

Korea nationals except for the pre-report of foreign investment and registration of a foreign

invested company. But, opening a private business doesn’t need to registration for

Incorporation.

1. Foreign Investment Notification

– Persons required filing the notification at designated head offices or branches of domestic banks (foreign exchange bank) and domestic branches of foreign banks.

2. Investment Capital Remittance

– Investment capital may be remitted to domestic banks from overseas, at this time, domestic capital doesn’t approval. (Remitter and recipient name have to be same.)

3. Incorporation/Business Registration

– Place for registration – A competent court and jurisdictional tax office.

4. Transfer of Paid-In Capital to Corporate Account

– Upon completion of the incorporation registration and business registration, companies are incorporated and the paid-in capital deposited in a temporary account can be transferred to a corporate account.

5. Foreign Investment Company Registration

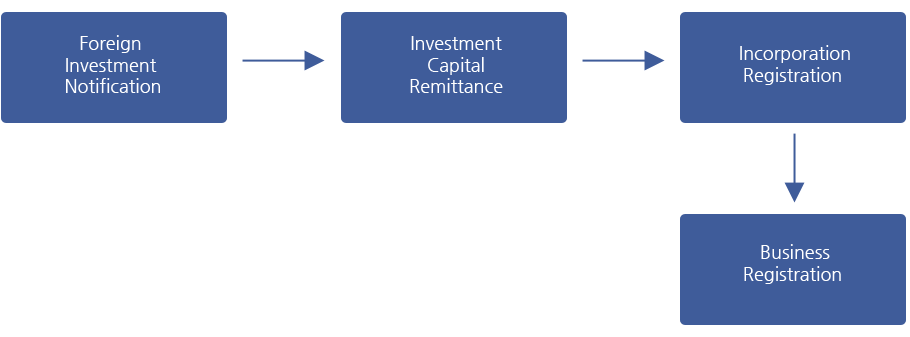

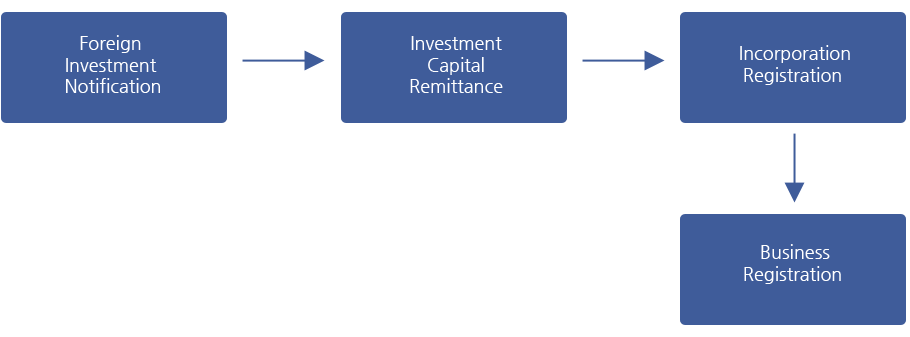

B. Private business

Private businesses are treated equally as local corporations in its business activities.

Private business doesn’t require Incorporation Registration.

C. Branch office

Undergo the branch establishment procedure stipulated by the Foreign Exchange Transactions Act, and receive court registration. A branch undertakes sales activities in Korea to generate profit.

1. Notification of Branch Establishment

– In principal, a foreign company should report the establishment of a domestic branch to the head of a designated foreign exchange bank.

2. Registration of Branch Establishment

– Under the Commercial Act, ‘branched’ are collectively referred to as ‘business office’.

The Act stipulates that the establishment and registration of a business office is required where a foreign company carries business in Korea.

D. Liaison office

If you don’t have any commercial activity in Korea, you just get a liaison office.

No commercial activity contains preparatory and auxiliary activities as research, publicity , information gathering, etc.

A liaison office is kind of testing office before you establish a branch or local company in Korea.

It was exempt from most of tax implementation.

You ought to keep no commercial activity on liaison office in mind.

Commercial activity performed by a liaison office is prohibited and is taxed by NTS(National Tax Service).

Procedure of liaison office establishment

1) To establish a liaison office in Korea, one should complete the registration/application for a liaison office establishment and submit to chief of designated foreign exchange bank.

Documents to be submitted

▣ Establishment report of a liaison office

▣ Articles of incorporation, court registration or business license of head office-notarization is required when copies are submitted

▣ A copy of business license or a copy of the certificate of register, etc.

▣ Specification of the business item and its scope in Korea (ex. Business Plan)

▣ Other necessary documents

2) Secondly, an establishment of a liaison office should be reported to the tax office to acquire identification number within 20 days from the completion of establishment.

Documents to be submitted

▣ Application of business registration

▣ Copy of lease agreement

▣ Copy of establishment report of a liaison office of the foreign company

|